Lupine Publishers Journal of Surgery and Journal of Case Studies: Currently case studies drag the concentration of the investigators since each case present provides deep understanding in diagnosis and treatment methods. It is devoted to publishing case series and case reports. Articles must be genuine

Thursday, November 28, 2019

Lupine Publishers: Lupine Publishers | Fibonacci Circle in Fashion De...

Lupine Publishers: Lupine Publishers | Fibonacci Circle in Fashion De...: Lupine Publishers | Journal of Textile and Fashion Designing Editorial Fibonacci circle is a pattern which is created on the...

Wednesday, November 27, 2019

Lupine Publishers: Lupine Publishers | Selected Methods of Spatial An...

Lupine Publishers: Lupine Publishers | Selected Methods of Spatial An...: Lupine Publishers- Environmental and Soil Science Journal Spatial analysis in GIS Wednesday is based on complex techniques, the r...

Tuesday, November 26, 2019

Lupine Publishers: Lupine Publishers | The Role of Technology Transfe...

Lupine Publishers: Lupine Publishers | The Role of Technology Transfe...: Abstract No doubt that climatic development and related changes are not new, bur a worldwide phenomenon that never respected nat...

Monday, November 25, 2019

Lupine Publishers: Lupine Publishers | The Benefits of Sports Medicin...

Lupine Publishers: Lupine Publishers | The Benefits of Sports Medicin...: Lupine Publishers | Journal of Orthopaedics Opinion Physiotherapy and Sports Medicine in a new concept focused not only on...

Friday, November 22, 2019

Lupine Publishers: Lupine Publishers | Utilization of Forecasting Glo...

Lupine Publishers: Lupine Publishers | Utilization of Forecasting Glo...: Lupine Publishers | Journal of Textile and Fashion Designing Editorial Considering the importance of technology and the hu...

Thursday, November 21, 2019

Lupine Publishers: Lupine Publishers | Is the salvation of life on th...

Lupine Publishers: Lupine Publishers | Is the salvation of life on th...: Lupine Publishers- Environmental and Soil Science Journal Before the advent of modern industry, nature had tangible additions in...

Wednesday, November 20, 2019

Lupine Publishers: Lupine Publishers | Evaluation of Host Associated ...

Lupine Publishers: Lupine Publishers | Evaluation of Host Associated ...: Lupine Publishers- Environmental and Soil Science Journal Abstract The water quality of many waterways in the state of ...

Tuesday, November 19, 2019

Lupine Publishers: Lupine Publishers | Crack and Leakage Detection on...

Lupine Publishers: Lupine Publishers | Crack and Leakage Detection on...: Lupine Publishers- Environmental and Soil Science Journal Abstract In this study, a method of water leakage detection s...

Lupine Publishers: Lupine Publishers | Evaluation of Host Associated ...

Lupine Publishers: Lupine Publishers | Evaluation of Host Associated ...: Lupine Publishers- Environmental and Soil Science Journal Abstract The water quality of many waterways in the state of ...

Saturday, November 16, 2019

Lupine Publishers: Lupine Publishers| Expected Seismic Risk in a Dist...

Lupine Publishers: Lupine Publishers| Expected Seismic Risk in a Dist...: Lupine Publishers- Trends in Civil Engineering and its Architecture Abstract The current study focuses on a sub-urban se...

Friday, November 15, 2019

Lupine Publishers: Lupine Publishers | Review of the Effect of Climat...

Lupine Publishers: Lupine Publishers | Review of the Effect of Climat...: Lupine Publishers- Environmental and Soil Science Journal Abstract The Researchers proved that the process of soil erosion is a...

Wednesday, November 13, 2019

Lupine Publishers: Lupine Publishers | 90 90 90 Formulas and Symptoms...

Lupine Publishers: Lupine Publishers | 90 90 90 Formulas and Symptoms...: Lupine Publishers | Journal of Orthopaedics Abstract Early decompressive adrenal fatigues have one of the leading causes of ...

Lupine Publishers: Lupine Publishers | Fibre Reinforced Composites: M...

Lupine Publishers: Lupine Publishers | Fibre Reinforced Composites: M...: Lupine Publishers | Journal of Textile and Fashion Designing Introduction Today, at the age of developing newer materials, i...

Lupine Publishers: Lupine Publishers | Domestic Violence Perpetration...

Lupine Publishers: Lupine Publishers | Domestic Violence Perpetration...: Lupine Publishers | Journal of Orthopedics Abstract A face is an index of mind correlation, co-efficient of mind. Domesti...

Monday, November 11, 2019

Lupine Publishers: Lupine Publishers | Review of the Effect of Climat...

Lupine Publishers: Lupine Publishers | Review of the Effect of Climat...: Lupine Publishers- Environmental and Soil Science Journal Abstract The Researchers proved that the process of soil eros...

Friday, November 8, 2019

Lupine Publishers: Lupine Publishers | The Study of Parameters and Re...

Lupine Publishers: Lupine Publishers | The Study of Parameters and Re...: Lupine Publishers- Environmental and Soil Science Journal Introduction In recent years, both in the Republic and in the...

Wednesday, November 6, 2019

Lupine Publishers: Lupine Publishers | Dyes and Dyeing

Lupine Publishers: Lupine Publishers | Dyes and Dyeing: Lupine Publishers | Journal of Textile and Fashion Designing Abstract Dyeing in ancient times was conducted from natural animal and...

Lupine Publishers: Lupine Publishers | Midshaft Clavicle Malunion wit...

Lupine Publishers: Lupine Publishers | Midshaft Clavicle Malunion wit...: Lupine Publishers | Journal of Orthopaedics Abstract Purpose: We are presenting this pattern of a rare variant of a clavic...

Lupine Publishers: Lupine Publishers | Extraction of Pectic Acid from...

Lupine Publishers: Lupine Publishers | Extraction of Pectic Acid from...: Lupine Publishers | Journal of Textile and Fashion Designing Abstract Extraction of pectic acid by acid hydrolysis from citr...

Tuesday, November 5, 2019

Lupine Publishers |Expectations in the Purchase of Health Insurance Plans: An Experiment in the City Of Barranquilla (Colombia)

Lupine Publishers | Journal of Health Research and Reviews

Abstract

Introduction

However, this way of relating the interaction between health insurance policies and policy holders does not reflect the role of subjectivity and its influence on people´s decision to purchase health insurances. In order to contrast the perspective of McCue and Hall, a survey was conducted to 50 medical insurance policyholders in the city of Barranquilla (Colombia) on the perception of various services offered by their insurance policies before being used following the experiment of Chew-Graham (2017) that highlights the possibility of having complementary medical insurance as a determinant for a high perception of quality before use it. The respondents were divided into two groups, the first group of 25 insured has additional benefits in their health insurance (spas, hydrotherapy, thalassotheraphy) while the other group of 25 does not. From a Likert survey ranging from 1 to 5, they were asked about three items: a variety of doctors and health centers that their insurance plan offer, medical attention and follow-up care after medical procedures, timely assistance before, during and after consumption of medical services.

It should be taken into account that none of the policyholders in the two groups had used their insurance policies until the date of the survey, which, according to McCue and Hall’s position, the surveys should show no perception of quality of their insurance plans before use it. The hypothesis of this experiment is that policyholders have different expectations in their medical insurance before using them because they have variable preferences (Gritcher and Cox, 1996) where policyholders are encouraged in different ways to select different health insurance that does not necessarily reflect a completely rational decision. In this sense, direct and indirect incentives [4] influence the creation of biases that influence the choice of policyholders, hence the creation of different expectations before the acquisition and consumption of medical insurance services.

Methodology and conceptual framework

Hypothesis

The hypothesis is that the perception of quality of complementary medical insurance is no necessarily related to its consumption in a different cultural and geographical context. This is based on a Likert survey with three items with scale from 1 to 3 where 1 is a low perception and 3 a high. The first item asks about whether the insurance policy contracted offers a wide variety of medical centers and specialist doctors for their health care services. The second item asks about whether the insurance company continually assists its policyholders after a medical procedure. The third item asks about whether the insurance company provides timely assistance in the face of an adverse health condition. The first step of the study was the selection and verification of the suitability of the respondents in terms of having complementary medical insurance subscribed in the same period of time. Half (25) with complementary medical care benefits services and the other 25 without it, with similar policies in the availability of specialist doctors and health centers. In this step, insurers that had similarity in their policies with differences in complementary services were also selected. The second step was to carry out the survey of the target population based on the three items described above. The third step was the statistical analysis by means of the tests Test Kolmogorov Smirnov (KS) and Test U Mann Whitney in order to determine if the provision of complementary medical services affects the perception of quality of medical insurance even when these are not consumed.Main objective

The main objective is to statistically determine the perception of quality of 50 insured surveyed in the city of Barranquilla with complementary medical insurance replying the Chew- Graham experiment in order to determine if the perception of quality varies for the two groups before they use their insurance benefits. The study population was divided into two groups; the first group 25 insured have the option to enjoy wellness medicine procedures (thalassotherapy, hydrotherapy and spas) with a lower co-payment than the individual payment of procedures. The second group of 25 is composed of policyholders who do not have this additional benefit even when both policies are very similar in coverage of medicines, clinics and number of physicians to which the insured can access. The sample was obtained on December 6, 2017, first group of policyholders’ states that they have not yet enjoyed the extra benefits of their policies.Participants

Two groups of 50 individuals with complementary medical insurance in the city of Barranquilla were surveyed. The first group of 25 insured has a health insurance policy that offers coverage in complementary medical services (thalassotherapy, spa, and spa) and the other 25 insured do not have that additional benefit. Both groups of respondents have similar characteristics in gender parity (25 men and 25 women), education (both groups claimed to have a university degree), age (35-45 years) and per capita income (they claimed to have between 5-10 minimum legal monthly salary). The insurers that offer the two different medical insurance are are Colmedica Prepaid Medicine and Coomeva Prepaid Medicine. Both providers of complementary medical insurance.This study was divided in three phases. In the first one, a characterization diagnosis of the participants was made in order to determine if they have similarity in levels of education, income, gender parity and ages. In the second stage, the target population was asked to complete a three-item survey on their perception of the quality of the two insurance policies in the city of Barranquilla. In the third phase it was determined if there is a differentiated perception about the quality of the health services through the Kolmogorov Smirnov Test (K-S) and the U Mann Whitney Test.

Parametric and non-parametric tests

Before the beginning of the statistical tests to prove the hypothesis, it is necessary to highlight an important element as a fundamental requirement to choose an appropriate statistical test. In this case, the difference between parametric and nonparametric tests will be briefly mentioned, in order to justify the usefulness of the U Mann Whitney test. Parametric statistics refers to the set of statistical procedures that allow knowing the distribution of the data, that is, if the data meet the necessary parameters to know what type of distribution the data has. On the contrary, if the distribution of the data is unknown and it is not known how these behave, then non-parametric tests should be applied. In addition, it is convenient to use non-parametric tests when minimum requirements or statistical assumptions are not met, such as small sample sizes (n <30), non-normal data distribution, that is, when there is a tendency in the data and its distribution is not in the form of a Gaussian bell and the variables are not continuous [5]. To apply parametric tests it is necessary to verify that the requirements or assumptions that conform to this type of tests are met.i. Test Kolmogorov Smirnov (K-S)

a. P-value> 0.05 → The data comes from a normal distribution, it is possible to use the parametric techniques.

b. P-value <0.05 → The data have an unknown distribution, it is advisable to use nonparametric techniques.

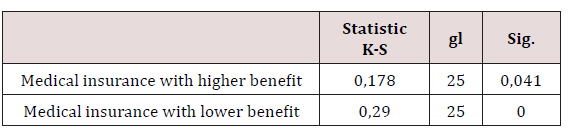

For the research case, this procedure was applied in order to determine the normality of the data, finding the following: As seen in table 1, the results show a p-value <0.05 for each group evaluated, that is, the data have an unknown distribution and do not meet the assumption of normality, therefore, it is acceptable to use non-parametric techniques for achieving the main objective.

Source: Own calculation with SPSS, 23.

U Mann Whitney test

The U Mann Whitney test is a type of non-parametric technique in which the purpose is to contrast the mean of a variable in two independent groups and verify whether it is different or not in a significant way. The U Mann Whitney test is the non-parametric alternative to the Student T test, when it is not possible to comply with the assumptions or requirements to apply it. This test is used when the observations of both groups are independent and the variables are ordinal or continuous (Scale from 1 to 3, ordinal), in addition, it is important to have the same size in both groups (in this case 25 surveyed in each group).Procedure

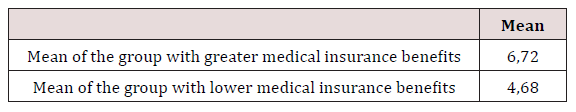

The perception of quality is composed of three variables: variety of services, support and timely medical assistance. However, to obtain a variable that would allow to include the general perception and also to compare both groups, the three questions evaluated were aggregated in order to achieve a total score for each respondent, where the highest total scores indicate a greater perception and On the other hand, lower total scores indicate a lower perception of quality. Given that the instrument consists of three questions, the highest possible score that both groups can obtain is 9 points, corresponding to answer High (3) in all. On the contrary, the minimum possible score that can be obtained by both groups is 3, corresponding to Low (1) in all the questions. In this way, the total score can be seen where the values close to the theoretical maximum (9) correspond to a better evaluation and the total scores close to the theoretical minimum (3) correspond to a low evaluation.Once the total score of each respondent was obtained, the total average per group was obtained, as shown in table 2. It is observed that in the group with greater benefits, the perception of quality in general is higher than in the group with the lowest benefits. However, it is necessary to test whether this difference is statistically significant with the U Mann Whitney test.

Source: Own calculation with SPSS, 23.

Application and interpretation of U Mann Whitney test.

The U Mann Whitney test contrasts the hypothesis if the means of both groups are the same or on the contrary they do not present differences. In this case it can be expressed as follows:a. P-value> 0.05 → The mean in both groups are the same.

b. P-value <0.05 → The mean in both groups are different.

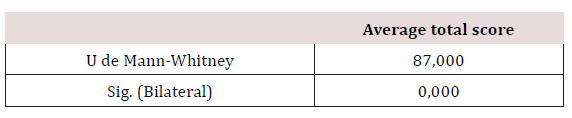

The results shown by the statistical software allow to obviate all the manual procedure of calculation of the test and to obtain the necessary values for the statistical interpretation. Table 3 allows to evaluate if the average scores (perception) between both groups are the same or not (Table 3).

Group variable: Affiliation to medical insurance policy

Discussion and Conclusion

For more Lupine Publishers Open Access Journals Please visit our website:

http://lupinepublishers.us/

For more Research and Reviews on Healthcare articles Please Click Here:

https://lupinepublishers.com/research-and-reviews-journal/

To Know More About Open Access Publishers Please Click on Lupine Publishers

Follow on Linkedin : https://www.linkedin.com/company/lupinepublishers

Follow on Twitter : https://twitter.com/lupine_online

Monday, November 4, 2019

Lupine Publishers: Lupine Publishers | Dyes and Dyeing

Lupine Publishers: Lupine Publishers | Dyes and Dyeing: Lupine Publishers | Journal of Textile and Fashion Designing Abstract Dyeing in ancient times was conducted from natural animal and...

Subscribe to:

Comments (Atom)

Lupine Publishers: Lupine Publishers| A Standard Pediatric Dental Clinic

Lupine Publishers: Lupine Publishers| A Standard Pediatric Dental Clinic : Lupine Publishers| Journal of Dentistry and Oral Health Care Aft...

-

Lupine Publishers: Lupine Publishers| A Standard Pediatric Dental Clinic : Lupine Publishers| Journal of Dentistry and Oral Health Care Aft...

-

Lupine Publishers | Journal of Health Research and Reviews Abstract Metabolism is the process your body uses to make energy f...

-

Lupine Publishers | Journal of Health Research and Reviews bstract Purity of the person is guarantee of his health. Spiritual and...